modular_trader.indicator.technical.rsi#

Classes#

Relative Strength Index (RSI) |

Module Contents#

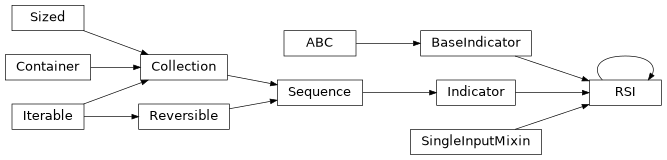

- class modular_trader.indicator.technical.rsi.RSI(period: int, input_indicator: modular_trader.indicator.technical.base.BaseIndicator | None = None, sampling_period: talipp.input.SamplingPeriodType | None = None, cache_size: int | None = None, name: str | None = None)#

Bases:

modular_trader.indicator.technical.base.BaseIndicator,talipp.indicators.RSI,modular_trader.indicator.technical.base.SingleInputMixin

Relative Strength Index (RSI)

The RSI is a technical indicator used to measure the strength of a stock or currency’s recent price action. It is an oscillator that computes the speed and change of price movements by comparing the magnitude of recent gains to recent losses. The RSI is usually plotted below an asset’s price chart and can have a reading from 0 to 100. Readings above 70 are considered overbought while readings below 30 are considered oversold.

- Args:

period (int): The period of the RSI. input_indicator (BaseIndicator | None): The input indicator. sampling_period (SamplingPeriodType | None): The sampling period. cache_size (int | None): The cache size. name (str | None): The name of the indicator.

- Parameters:

period (int)

input_indicator (modular_trader.indicator.technical.base.BaseIndicator | None)

sampling_period (talipp.input.SamplingPeriodType | None)

cache_size (int | None)

name (str | None)